Does Your Business Need Key Person Life Insurance?

If you are the sole proprietor of a small business or have significant ownership in the partnership or small corporation, you may be interested in key person life insurance (formally known as Key Man Life Insurance). It’s one of the most important forms of business insurance, because it can enable a business to continue functioning in the aftermath of the death of one of its most important members.

What is Key Person Life Insurance?

Even though key person life insurance is taken on the life of an owner or employee, it’s owned by the business. The business pays the premiums and is also listed as the beneficiary of the policy.

Key person life insurance is so named because it is a policy take on the life of one or more persons who play a critical role in a business. It can be a business partner, major shareholder, or even an employee. The loss of this person will significantly impair business operations to the point of even threatening the ability of the business to continue in operation.

For this reason, key person insurance was developed. The purpose of the policy is to provide businesses with the financial resources to continue in operation even upon the death of a person deeply critical to the enterprise.

Still another important function of key person life insurance is enabling a business entity to continue operating upon the death of one of its owners.

Typically, an owner brings certain critical resources to a business. It may be capital, managerial skills, marketing and sales ability, important technical know-how, or even significant business contacts. Key person life insurance can help a business to survive the loss of that person’s contribution, as well as make an attempt to replace the skills lost.

But one of the most important features is that the policy also enables a business to buy out the ownership position of the deceased partner. It can provide the business with capital to pay the heirs of the deceased partner so that the remaining owners retain full control. That function not only benefits the business but will also provide much-needed monetary proceeds to the deceased’s family.

Who is a “Key Person” in Your Business?

As a general rule, if the death of a person within your business will cause financial distress, key person life insurance should be considered.

It should be automatic in regard to partners and major shareholders. But you should also carefully evaluate if it may be needed for certain mission-critical employees.

The list can include managers, marketing and sales people, or even an administrative employee who has intimate knowledge of business operations. Any of these should be a consideration, particularly in

a very small business, where the contribution of a single employee has a major impact on business operations.

Determining the Amount of Life Insurance Needed

The amount of coverage needed will depend upon the contribution that is made by the partner, shareholder, or employee.

The amount of coverage needed will depend upon the contribution that is made by the partner, shareholder, or employee.

In the case of partners and shareholders, the minimum amount of the policy should be sufficient to buyout the member’s ownership stake in the business. The amount may be increased based on the tangible contribution that the member makes to business operations.

In the case of employees, there’s no ownership interest that needs to be bought out. But an employee’s contribution to the business may be out of all proportion to his or her level of compensation.

For example, if you have a salesperson who brings in say, 50% of your company’s sales, you may want to have a death benefit large enough to cover the loss of revenue until you can reasonably expect to find another salesperson to fill the void.

At a minimum, there should be sufficient life insurance on any key person that you will have time to find someone else to fill the position in y

our business.

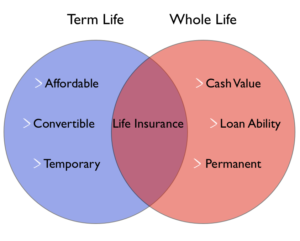

Term or Whole… Which Is My Best Choice for a Key Person Life Insurance?

It depends on your budget and needs. Since the cost of key person life insurance will be paid by the business, you’ll probably want to keep the premium as low as possible. This will be much better accomplished using a term life insurance policy. Since term is pure life insurance and does n

It depends on your budget and needs. Since the cost of key person life insurance will be paid by the business, you’ll probably want to keep the premium as low as possible. This will be much better accomplished using a term life insurance policy. Since term is pure life insurance and does n

ot include an investment option, it will be the least expensive policy possible.

That will be important on several fronts, because not only do you want to keep the cost of the policy low, but you also want to make sure that you can buy the full amount of coverage that you will need in the event that a partner, owner, or an important employee is lost.

Term life insurance also matches up better with key person coverage. For example, let’s say th

at you plan to sell your business and retire in 10 years. You would only need coverage on your partners or employees for 10 years, which can be served by purchasing a 10-year term life insurance policy.

Whole life insurance, on the other hand, is permanent life insurance, which means that you will pay more for a policy that you will eventually no longer need. The benefits of a Whole Life policy, however, can be the ability for it earn cash value and be utilized by the business for loans on company purchased equipment and properties.

If you are a small business owner, consider the people involved in your business. If the death of any one of them would be catastrophic for your business, then you need to take a serious look at key person life insurance. Please, give me a call and let me help you find the best coveragefor your business at the best value for your budget and protection needs.